Your Quick Guide to Making Direct Deposit a Breeze

If you’ve ever stared at a blank check and wondered, “What do I do with this to set up direct deposit?” you’re not alone. We’ve all been there—trying to get paid faster without the hassle of paper checks. Enter the voided check examples that make the whole process feel less like adulting and more like a simple hack. Today, we’re diving into what a voided check is, why it’s your new best friend for payroll, and some super straightforward sample of a voided check to get you sorted. Let’s keep it real and casual—no finance jargon overload, promise.

What’s the Deal with a Voided Check, Anyway?

You’re excited about that new job, but HR hits you with, “Hey, we need a voided check for direct deposit.” Panic mode? Nah, it’s easier than ordering takeout. A voided check is basically a regular check from your bank account that you’ve scribbled “VOID” across it in big, bold letters. Why? It can’t be cashed or deposited anymore (safety first!), but it shares all the juicy details your employer needs: your routing number, account number, and bank name. Boom—direct deposit unlocked.

It’s like handing over your bank’s business card without the risk. No more waiting for checks in the mail or running to the bank every payday. Pro tip: This isn’t just for jobs; landlords, investment apps, or even government benefits might ask for one too.

Why Bother with an Example of a Voided Check for Direct Deposit?

Direct deposit is the MVP of modern paydays—faster funds, fewer fees, and zero lost mail drama. But to set it up, your employer (or whoever) needs proof of your bank deets. That’s where the example of a voided check for direct deposit comes in clutch. It verifies everything without you typing out numbers that could lead to typos (and awkward “oops, wrong account” moments).

Fun fact: Over 90% of Americans use direct deposit now. If you’re not on board yet, a quick voided check gets you there in minutes. Plus, it’s free—no special fees from your bank.

How to Void Your Own Check (Like a Pro)

Grab a check from your checkbook (or print one if you’re fancy). Here’s the casual step-by-step—no fancy tools required:

- Snag a fresh check: Use a blank one from your starter pack. Don’t use a pre-filled one unless you’re 100% sure it’s okay to nix.

- Write “VOID” like you mean it: Use a thick pen (blue or black, not pencil—duh). Slap it across the front in huge letters, covering the signature line, date, and payee spots. Make it messy if you want; the goal is to render it useless for cashing.

- Double-check the back: Some folks VOID the back too, just in case. Overkill? Maybe, but better safe than sorry.

- Photocopy or snap a pic: Hand over a copy, not the original. Keep the real deal in your files for your records.

That’s it! If your bank doesn’t send checks (hello, digital age), hit ’em up for a “voided check letter” or just print a voided version of your account statement with the key info.

Voided Check Examples: Visuals to Steal… Er, Inspire

Words are cool, but seeing is believing. Here are some voided check examples broken down simply. Imagine these as your cheat sheet—no need to draw from scratch.

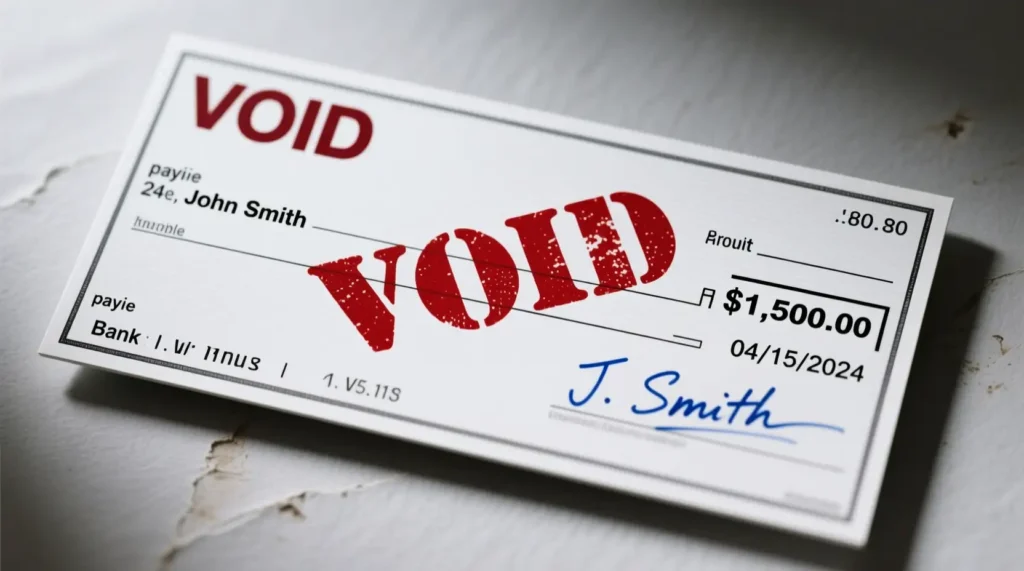

Sample of a Voided Check (The Classic Look)

Think of a standard business check: Top left has your bank’s name and routing number (those nine digits starting with 0, 1, 2, or 12-ish). Bottom left? Your account number. The payee line, amount boxes, and signature spot are all crossed out with “VOID” in caps.

Here’s a super basic text mock-up (because who doesn’t love ASCII art?):

[Bank Name & Logo] Routing: 123456789

Your Name Account: 9876543210

Check #: 001

Pay to the Order of: VOID VOID VOID $_______________ VOID VOID VOID

Memo: ____

Date: //_ VOID VOID VOID Signature: ____________ VOID VOID VOID

See? The “VOID”s overlap everything spendable. This sample of a voided check is what most folks submit—clear, scannable, and foolproof.

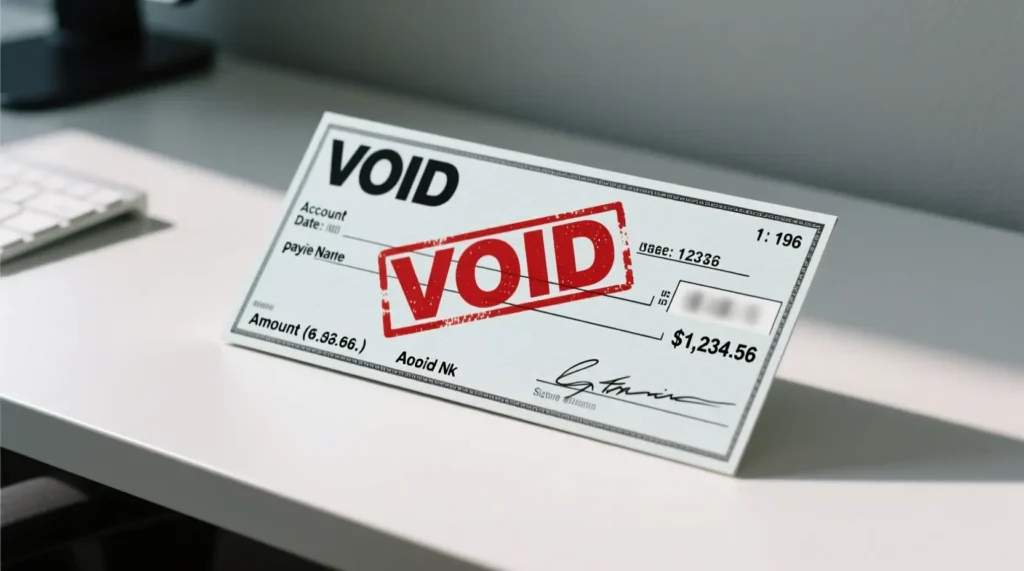

Sample Voided Check for Direct Deposit (Direct Deposit Edition)

For payroll pros, it’s the same vibe but zoomed in on the numbers. Employers just need the routing and account digits, so highlight those if you’re feeling extra helpful.

Text version for your sample voided check for direct deposit:

DIRECT DEPOSIT SETUP - VOIDED CHECK SAMPLE

-------------------------------------------------

Bank: First National Bank

Routing Number: 123456789 <-- Key for transfers

Account Number: 9876543210 <-- Your money's home

Check Number: 001

[Big VOID across the whole check body]

VOID - DO NOT CASH

-------------------------------------------------In real life, you’d scan or photo this bad boy and email it over. If you’re digital-only, apps like Chase or Wells Fargo let you generate a PDF version online. Easy peasy.

Quick Tips to Avoid the “Voided Check Blues”

- Lost your checkbook? Call your bank—they’ll mail one or email a template ASAP.

- Privacy paranoia? Black out anything non-essential before sharing.

- What if it’s rejected? Double-check those numbers match your online banking. Typos are the silent killer.

- Eco-friendly hack: Go paperless! Ask for a direct deposit authorization form instead.

There you have it—voided check examples demystified, with zero stress. Next payday, you’ll be high-fiving your bank account while others chase the mailman. Got questions or need more tweaks? Drop a comment below. Here’s to smoother money flows.