Remember the days of scribbling checks by hand while cursing your shaky handwriting? Yeah, check writing doesn’t have to be a relic from the ’90s—it’s evolved into slick online check writer tools and apps that make paying bills feel like swiping on Tinder. Whether you’re hunting for a free online check writer, setting up one write checks for business, or just need a refresher on check writing format, we’ve got you covered. In this chill guide, we’ll break down the basics, geek out on digital hacks, and even tackle those pesky amount write-outs like $100 check write out or 1000 dollar check example. Let’s make your wallet (and sanity) happier, one signature at a time.

Back to Basics: Mastering the Art of Check Writing

If you’re old-school or just starting out, nailing check writing starts with the fundamentals. Grab a pen, a blank check, and let’s fill it out like pros. The goal? Clear, fraud-proof scribbles that get your cash where it needs to go.

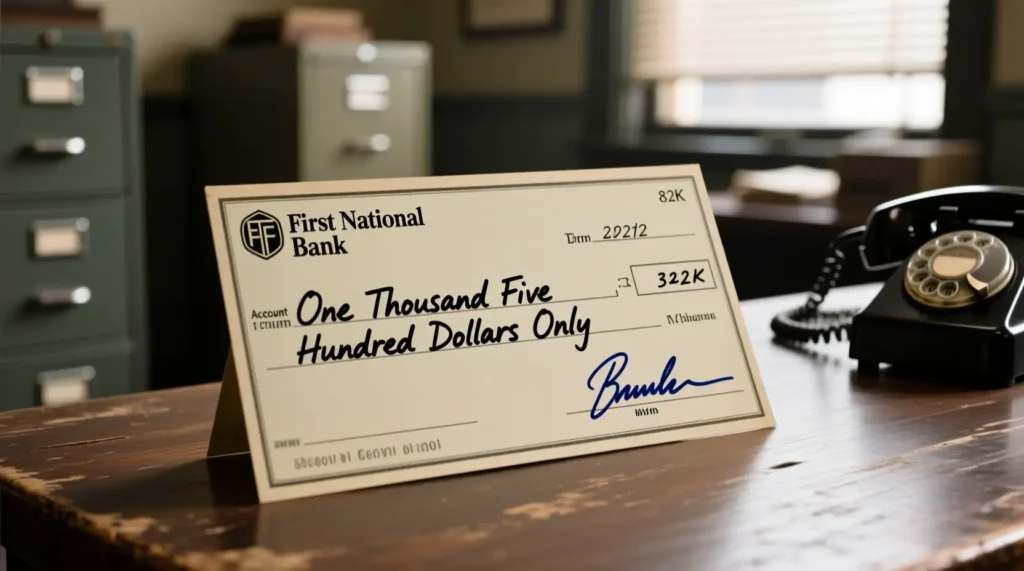

Here’s the lowdown on check writing example and sample check filled out:

- Date it right: Top right corner—use MM/DD/YYYY. No future-dating unless you’re playing time traveler.

- Payee line: “Pay to the Order of” – spell out the name or company. No abbreviations if you can help it.

- Amount in numbers: Dollar sign, then the bucks and cents (e.g., $130.45). Draw a line after to block tampering.

- Amount in words: Below the payee—key for avoiding disputes. More on this in a sec.

- Memo: Optional note, like “Rent – Nov 2025.”

- Signature: Yours, at the bottom. Make it match your bank’s records.

Pro tip: Practice with check writing practice sheets online to avoid that “checks filled out” cringe. And if you’re in the UK or Canada, swap to cheque writer mode—same vibe, different spelling.

Writing Out Amounts: From $15 Dollar Check to $2500 Check Write

Ah, the fun part—writing checks with cents without turning into a word wizard. The rule? Spell it out in words on the line below the payee, then slash and add /100 for cents. It prevents sneaky alterations. Here’s a cheat sheet for common ones, pulled from real check writing format guides:

- 15 dollar check: Fifteen and 00/100 dollars

- $100 check write out or 100 dollar check: One hundred and 00/100 dollars

- 120 check write: One hundred twenty and 00/100 dollars

- 150 check write: One hundred fifty and 00/100 dollars

- $1000 check write or 1000 dollar check example: One thousand and 00/100 dollars

- 1050 check writing: One thousand fifty and 00/100 dollars

- 1100 check write: One thousand one hundred and 00/100 dollars

- 1150 check writing: One thousand one hundred fifty and 00/100 dollars

- 1250 check writing: One thousand two hundred fifty and 00/100 dollars

- 1300 check writing: One thousand three hundred and 00/100 dollars

- 1500 check write: One thousand five hundred and 00/100 dollars

- 1700 check writing: One thousand seven hundred and 00/100 dollars

- 175 check writing: One hundred seventy-five and 00/100 dollars

- 1800 check writing: One thousand eight hundred and 00/100 dollars

- 1900 check writing: One thousand nine hundred and 00/100 dollars

- 200 check write: Two hundred and 00/100 dollars

- 2400 check writing: Two thousand four hundred and 00/100 dollars

- 250 check write: Two hundred fifty and 00/100 dollars

- 2500 check write: Two thousand five hundred and 00/100 dollars

- 10000 cheque writing: Ten thousand and 00/100 dollars (or pounds, if you’re across the pond)

For cents, like $100 dollar check write with 45¢: One hundred and 45/100 dollars. See? Easy as pie. If it’s even, just 00/100. Banks love this precision—it cuts fraud risks.

Level Up with Online Check Writers and Apps

Who has time for manual madness? Enter the online check writer era—free online check writer options let you write a check online free from your couch. No more check writing printer hunts; just plug in details and print on blank stock.

Top picks for 2025? Check out these gems:

- Checkeeper: Killer for business check printing online. Print on plain paper, mail ’em out—boom, done.

- EZ Check Writer or Easy Check Writer: Drag-and-drop magic for check writing programs free. Great for solos or small crews.

- Check Writer App (iOS/Android): Mobile-first check writer app for windows vibes, but works everywhere. Check writer apk download for Android fans—write checks online free on the go.

- Online Check Writer by Zil Money: Free check writer with payroll perks. Integrates like a dream for payroll check writer needs.

- Check Writer Pro or MyCheck Writer: Pro-level for check writer pro users, with unlimited check writing tiers.

- ECheck Writer or Electronic Check Writer: Go digital with write an echeck for instant transfers—echeck writer at its finest.

For best check writing app seekers, apps like these slash costs (no ordering pre-printed checks) and amp security. Bonus: Online cheque writer for international flair, and digital check writer for eco-warriors ditching paper.

Business Boss Moves: QuickBooks, Payroll, and One-Write Systems

Running a hustle? One write checks (or one write system checks) streamline one write checks for business—write once, post to ledger automatically. But the real MVP? QuickBooks check writing.

In QuickBooks Online, write checks QuickBooks Online like this: Hit + New > Check, pick your bank account, add payee/vendor, enter amount, and save/print. For printing checks from QuickBooks Online, snag compatible stock and let it rip—write a check in QuickBooks Online in under a minute. Desktop users? Printing checks from QuickBooks Desktop follows suit, just swap menus.

For payroll pros, payroll check online check writer tools like Checkrun integrate seamlessly—business check writer heaven. And don’t sleep on check writing service for outsourcing the hassle.

Perks of Money Market Accounts with Check Writing

Want interest and flexibility? Hunt a money market account with check writing or money market with check writing. These hybrids let you earn APYs (up to 4.25% in 2025) while enjoying unlimited check writing and debit perks.

Standouts:

- Sallie Mae: No-minimum money market account write checks, check-writing included.

- Quontic or U.S. Bank Elite: Money market account you can write checks with ATM access.

- Fidelity: Fill the Fidelity checkwriting form for seamless setup—Fidelity check writing FTW.

Pro: Higher yields than plain checking. Con: Watch for transaction limits. Check writer’s bank near me? Apps make it nationwide.

Quick Hacks and Freebies to Wrap It Up

- Free check printing online: Zil or Checkeeper trials—check printing program free galore.

- Computer check writing programs: Check writing programs like check printing softwares for bulk jobs.

- Live online check writer: Real-time collab for teams via online check writers.

- Check writer download: Grab check writer download from trusted sites—online check writer download for the win.

- Personal check writer: Keep it simple with apps for solo users.

- Checks writer collectives? Nah, but check writing companies handle enterprise scale.

There you have it—check writing decoded, from check writing system basics to online check writing service wizardry. Ditch the errors, embrace the ease, and maybe even run an essay repetition checker on your memos for fun (kidding—stick to finances). Got a check writer’s bank story or app rec? Spill in the comments. Happy writing.